Industrial Design Registration in the UAE: Complete Legal Guide for 2026

In today’s competitive global market, product appearance can be as valuable as the product itself. From packaging and consumer electronics...

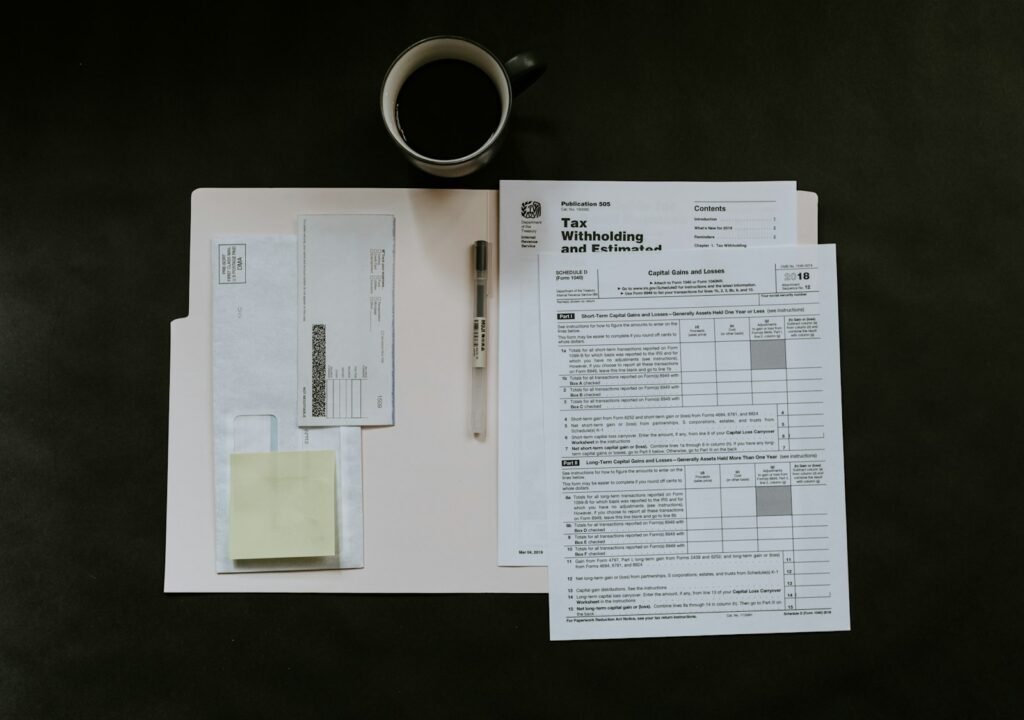

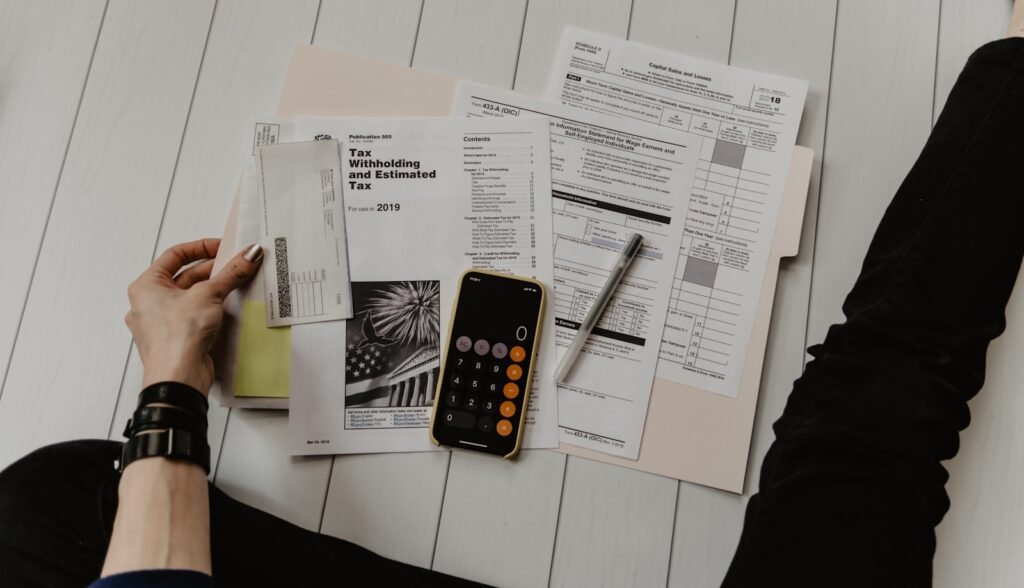

In the UAE, sound accounting isn’t optional — it’s the backbone of compliance, investor confidence, and growth. Whether you’re a startup in Dubai, a trading company in Sharjah, an investor in Abu Dhabi, or a law firm operating across the Northern Emirates, professional accounting services keep you compliant with VAT rules, corporate tax filing obligations, payroll laws and commercial reporting standards. For lawyers and law firms the stakes are higher: poor accounting risks client disputes, impaired trust, professional regulation headaches, and fines. Treat accounting as a cost center and you’ll pay for it later in penalties and lost business; treat it as a control center and it becomes a competitive advantage.

Recent tax and regulatory changes make this especially urgent. The UAE introduced a federal corporate tax regime effective for financial years starting on or after 1 June 2023, changing the way businesses — including free zone entities — plan their tax and reporting strategy. At the same time, VAT at a 5% standard rate remains a core operational requirement for most businesses, with mandatory registration applying once taxable supplies exceed AED 375,000 per year. Economic substance rules and other reporting obligations mean companies must prove real activity and properly document financial flows.

Accounting services in the UAE therefore span far beyond “books.” They include real-time bookkeeping and reconciliation, VAT registration and return preparation, payroll calculation and labour-compliance reporting, corporate tax readiness and filings, audit support and management reporting tailored to UAE regulators, banks and investors. For law firms and lawyers specifically, there’s added complexity: client escrow accounting, trust accounting segregation, billing and time capture that meets legal ethics standards, and forensic-ready records for dispute prevention or resolution.

A professional accounting partner in the UAE should deliver three things: accuracy, timeliness, and advisory. Accuracy protects you from fines and interest. Timeliness keeps filings, payroll and bank covenants satisfied. Advisory helps you structure transactions, cashflow and compliance in tax-efficient and defensible ways — for example, preparing transfer pricing documentation where relevant, advising on free zone vs mainland tax positions, or setting up VAT-efficient supply chains.

Geography matters in the Emirates. Dubai, Abu Dhabi, Sharjah, Ras Al Khaimah and other free zones each have distinct commercial ecosystems — but tax and VAT obligations are federal, so your accounting needs must be centrally coordinated. Good service providers combine local presence (to support banks, auditors and regulators in Dubai, Abu Dhabi, Sharjah and other cities) with centralized systems so your numbers are always auditable and ready for decision-makers, investors, or courts.

If you’re a law firm, founder, or CFO reading this: don’t let accounting be a rear-guard operation. Build it into your strategy. Accurate accounting and proactive tax planning reduce disputes, accelerate fundraisings, prevent penalties, and make M&A or exits possible. Bookkeeping is where legal risk meets financial reality — and getting it right is one of the smartest investments any business in the UAE can make.

Accurate bookkeeping is the foundation for every other financial function — VAT, payroll, corporate tax, audits, and commercial decision-making. In the UAE landscape, bookkeeping must be precise, timely, and tailored to both federal requirements and sector-specific needs (for example, law firms that must manage client trust accounts separately). A credible bookkeeping service will deliver general ledger maintenance, supplier and customer ledger reconciliation, bank reconciliation, fixed asset registers, month-end close, management accounts and financial statements prepared according to International Financial Reporting Standards (IFRS) where applicable.

Why this matters: banks, investors, auditors and courts expect clean books. For law firms and lawyers, this is critical — client money must be ring-fenced and traceable; billing must be defensible; and trust accounting must survive scrutiny. Accurate books reduce the risk of regulatory fines from the Federal Tax Authority (FTA) or misstatements in corporate tax returns. They also reduce disputes with clients over fees, disbursements and retainer accounting.

Core deliverables typically include:

Daily transaction capture and timely coding to the chart of accounts.

Automated bank feeds and monthly bank reconciliations to eliminate unexplained variances.

Accounts receivable aging and proactive credit-control workflows to improve cash collection.

Accounts payable workflows with approval controls to reduce fraud risk and manage supplier terms.

Regular management reports: P&L, balance sheet, cash flow forecasts, KPI dashboards tailored for founders, CFOs and partners.

Monthly close and quarterly/annual IFRS-compliant financial statements for statutory or investor purposes.

Technology is non-negotiable. Modern UAE bookkeeping must use cloud-based accounting platforms that integrate with POS systems, e-invoicing gateways, payroll engines and bank feeds. These platforms enable remote access across Dubai, Abu Dhabi and other Emirates, faster month-end closes, and transparent audit trails. For law firms, integrations should support matter-level accounting and trust ledgers.

Value beyond compliance: bookkeeping becomes an insight engine. When accurate transactional data is available, you can model cash flow scenarios, prepare VAT projections, stress-test payroll costs, and evaluate the tax impact of business decisions. That turns accounting from a backward-looking control into forward-looking strategy.

Deliverables for law firms often include matter-based reporting (profitability by matter/client), escrow reconciliation, time-to-invoice metrics and client-retainer status — all designed to protect client funds and optimize revenue collection. In short: professional bookkeeping in the UAE reduces risk, improves cashflow, and lays the groundwork for tax-efficient planning and audit-ready financial statements.

VAT is a central operational obligation in the UAE. The Federal Tax Authority (FTA) enforces a 5% standard VAT rate on most goods and services, and resident businesses whose taxable supplies exceed AED 375,000 in the previous 12 months must register mandatorily (with a voluntary threshold available). These rules affect pricing, contract drafting, invoicing, cross-border supply chains, and cashflow.

A competent VAT compliance service delivers end-to-end support: assessing registration obligations for mainland and free zone operations, preparing and filing VAT returns, ensuring compliant invoicing, supporting VAT audits, and advising on zero-rating and exemptions where applicable. For service providers — including law firms and legal advisers — VAT raises specific questions about professional fees, disbursements recovery, and cross-border electronic services.

Key elements of VAT service:

VAT Health Check & Registration: Analyse turnover and supply types for Dubai, Abu Dhabi and other Emirates; determine mandatory vs voluntary registration; submit FTA registration and receive TRN (Tax Registration Number).

Invoicing & E-Invoicing Readiness: Ensure invoices meet FTA standards, prepare for any e-invoicing or digital reporting requirements, and set up templates that segregate VAT on disbursements properly for law firms.

Return Preparation & Submission: Accurate VAT returns with input tax recovery claims, timing adjustments and domestic reverse charge entries where needed.

Record Retention & Audit Support: Maintain electronic records and audit trails. In case of an FTA audit, provide representation and prepare supporting schedules, reconciliations and position papers.

Cross-border VAT Planning: Advise on import VAT, customs duties, and how to structure cross-border services to minimize VAT leakage.

Refunds & Special Schemes: Assist with VAT refund claims (e.g., VAT on imports) and special cases such as zero-rating on exports or specific reliefs.

For law firms, precise VAT treatment of fees, disbursements, international advice and retained-client arrangements is essential. Mistreating client disbursements or failing to correctly classify partially exempt supplies can create significant VAT exposure. Good VAT advisors will also coordinate with bookkeeping and payroll systems so claims and reporting are consistent across the business.

Recent and upcoming reforms mean VAT rules can evolve; having a technical VAT partner that monitors FTA updates and adjusts compliance processes saves money and protects reputation. Whether you operate in Jebel Ali Free Zone, ADGM, DIFC, or on the mainland in Abu Dhabi, VAT requirements are federal — but operational differences (e.g., customs processes, free zone business models) require local know-how.

Payroll in the UAE is more than paying salaries: it’s about complying with labour law, social security where applicable, end-of-service calculations, gratuity, employee benefits, and accurate payroll-related reporting. Mistakes here lead to employee complaints, fines, and reputational damage — especially for law firms, where professional reputation is paramount.

A full-service payroll solution includes timely salary payments, accurate tax and social-security contributions (for GCC nationals where applicable), payroll record keeping, P60/Payslip generation, leave and attendance integrations, and end-of-service gratuity calculations in line with UAE Labour Law. For companies hiring expatriates, payroll also ties into visa and labour contract compliance.

Core components:

Payroll Processing & Payslips: Automated processing that supports monthly, weekly or hybrid pay cycles, allowances, overtime and statutory deductions.

Labour Law Compliance: Correct gratuity calculations, notice period payments, leave encashment, and compliance with labour contract terms applicable in Dubai, Abu Dhabi and other Emirates.

Employee Benefit Administration: Health insurance coordination (mandatory in many emirates for residents), pension/social insurance for GCC nationals, and other benefits management.

Statutory Reporting & Records: Maintain payroll registers, employment contracts, NOC and visa-related documentation, and prepare payroll summaries for audits or bank covenant checks.

Integration with Accounting & HR Systems: Ensure payroll entries post to the general ledger automatically and reconcile with cash and bank statements.

Outsourced Payroll for Law Firms: Special handling for partner draws, matter-related billing splits, and partner remuneration structures common in legal practices.

Payroll accuracy is also essential for corporate tax and transfer pricing analysis: compensation affects profit, and inconsistent payroll records complicate tax positions. For firms operating across several Emirates, centralized payroll controls with local execution reduce compliance risk and improve employee satisfaction.

The UAE’s corporate tax regime, effective for financial years beginning on or after 1 June 2023, requires businesses to prepare for taxable profit computation, tax registration, and timely filing. The regime includes a standard headline rate (with a 9% rate applied to taxable income above certain thresholds for most businesses), and rules for large multinationals and free-zone entities that meet qualifying conditions.

Corporate tax readiness is a multi-step programme:

Tax Impact Assessment: Analyze existing accounting practices, revenue streams, intercompany transactions, and historical adjustments to determine likely taxable base and effective tax.

Tax Registration & Compliance Calendar: Prepare tax registrations and a filing calendar aligned with the entity’s financial year, ensuring the first returns are filed on time.

Permanent Establishment & Free Zone Analysis: Determine whether operations create a taxable presence on the mainland, and assess whether free zone exemptions or incentives apply.

Transfer Pricing & Documentation: Where related-party transactions are material, prepare contemporaneous transfer pricing documentation and policies to withstand scrutiny.

Tax Accounting & Provisions: Implement tax accounting (current and deferred tax), prepare tax provisions for financial statements, and reconcile tax positions to management accounts.

Tax Dispute & Audit Support: Represent the company in tax audits, prepare position papers, and negotiate with tax authorities to resolve queries or assessments.

For law firms, corporate tax adds layers: partner vs corporate profit treatment, appropriate tax accounting for retained earnings, and clear documentation for inter-firm transactions. The corporate tax framework interacts with VAT and payroll — coordinated accounting and tax planning across functions is essential to avoid double-counting costs or missing deductions.

Large multinationals should also watch the UAE’s adoption of international measures like the OECD minimum tax top-up (where applicable) and changes to transfer pricing rules. Specialist advisory helps structure groups to maintain competitiveness while remaining fully compliant.

When external auditors arrive, regulators open an inquiry, or a commercial dispute needs hard financial evidence, you need audit-ready records and an advisor who can translate numbers into defensible narratives. Audit support prepares your accounts and schedules to satisfy statutory auditors and regulators; forensic accounting uncovers discrepancies, quantifies losses, and prepares evidence for litigation or arbitration; financial advisory helps with valuations, restructuring, and transaction due diligence.

Audit support services include closing the books to meet auditors’ timetables, preparing audit schedules (bank reconciliations, fixed asset roll-forwards, related-party disclosures), and coordinating with external auditors in Dubai, Abu Dhabi or other Emirates. This reduces audit fees and shortens the audit cycle.

Forensic accounting covers:

Fraud investigation and irregularity testing.

Tracing of misapplied client funds or disbursement mismatches (critical for law firms).

Quantification of commercial damages for litigation, arbitration or settlement.

Expert witness reports and support in court or arbitral proceedings.

Financial advisory spans transaction support, valuations, carve-out accounting, and covenant modelling. Whether you’re preparing for M&A, refinancing, or restructuring, advisors produce the financial models and due diligence packs buyers, sellers and lenders demand.

Combining these services with bookkeeping, VAT and tax advisory creates a single source of truth for your business — and for law firms that often face client disputes or regulatory reviews, that combination is indispensable.

No. VAT registration is mandatory when taxable supplies and imports exceed AED 375,000 over the previous 12 months (voluntary registration is available at a lower threshold). Non-resident businesses have different considerations.

The UAE corporate tax applies broadly, but qualifying free zone entities may still benefit from specific incentives if they meet substance and other requirements. Each case requires a factual analysis and tax readiness assessment.

Law firms must keep client trust ledgers, matter-level billing records, invoices, bank reconciliations, payroll and employment contracts, VAT invoices and supporting documentation, and any contracts affecting revenue recognition. These records should be easily exportable for auditors or regulators.

Yes, but fixing retrospective errors can trigger penalties or additional tax assessments. Prompt correction, disclosure, and a technical position paper supported by reconciliations reduce risk. Working with an accounting/tax advisor limits exposure.

Monthly is best practice for operational control; quarterly for board reporting; and annual for statutory filing and tax calculations. Frequent management accounts improve cashflow control and VAT/corporate tax forecasting.

Payroll affects deductible expenses, provisos for end-of-service obligations, and tax base calculations. Accurate payroll records are required for both corporate tax computations and employment-law compliance.

The team was professional, responsive, and truly cared about my company registration process. Their clear communication and attention to detail made everything far easier than expected. Highly recommended.

Excellent service from start to finish. The team guided me through the import/export process with clear communication and reliable expertise. They handled all documentation efficiently, making the entire operation smooth and stress-free.

Fantastic experience! The team was knowledgeable, responsive, and guided me through the restaurant property purchase with ease. Their attention to detail and clear communication made the process seamless from start to finish.

In today’s competitive global market, product appearance can be as valuable as the product itself. From packaging and consumer electronics...

Innovation is the backbone of every successful startup. For investors, intellectual property is often the single most valuable asset on...

Patent Registration in the UAE is a critical legal step for inventors, startups, multinational corporations, and technology driven businesses seeking...