CIB Report in Bangladesh

What Is a CIB Report in Bangladesh? Why Is The CIB Report Crucial For Financial Institutions And Banks To Disburse Loans?

When we submit a complete application for a loan to a financial institution or bank, including all necessary documents, we are informed that the bank will proceed with the loan proposal once it has obtained a favourable CIB report. Although we possess a limited understanding of loan procedures, our knowledge is limited to the definition of a CIB report in a bank and the rationale behind its necessity for decision-making regarding loan provision to financial institutions such as the bank.

In developed nations, financial institutions and banks employ a variety of methods to establish the applicant’s eligibility for a loan. However, within our nation, the sole and official method for assessing the creditworthiness of an applicant is through the CIB report. In this discourse, I shall expound upon the contents of a CIB report and underscore the significance of CIB’s involvement prior to loan approval for a borrower.

To assess the creditworthiness of a borrower or applicant, Bangladesh Bank, the central bank of the nation, established the Credit Information Bureau (CIB), a central credit database, in 1992. This database examines the applicant’s prior loan conduct and repayment capacity. The primary aim of the Credit Information Bureau (CIB) is to streamline the process of consumer selection for financial institutions, including banks and other lenders.

Advantages of a CIB report in a bank;

- CIB mitigates the credit risk of financial institutions and banks by providing timely reports on credit information regarding loan applicants in response to inquiries or requests, thereby reducing the number of defaults or poor loans.

- In a competitive market, lending institutions typically approve loans on the applicant’s creditworthiness and track record of timely repayment. Financial institutions and banks have achieved substantial reductions in loan processing time, costs, and default loans through the utilization of CIB reports.

- Verbal information exchanges facilitate the identification of qualified borrowers by financial institutions and banks. In practice, however, CIB facilitates improved risk management, allowing financial institutions and banks to increase their lending volume to small and medium-sized businesses (SMEs) while avoiding hazardous large loans.

- Financial institutions and banks that report to the CIB database enable the appropriate exchange of credit information, which aids in lending decisions and the prevention of delinquent borrowers. That is to say, it decreases default rates for specific financial institutions and nations at large.

- Financial institutions and banks find CIB reports particularly useful when determining whether to lend to individuals and SMBs. When providing credit to sizable corporations, it has been determined that a thorough examination of the prospective borrower’s financial capacity and past payments is an adequate indicator of the likelihood that said corporations will default.

As a result of the consensus that the CIB report reduces the ex-post rate of default and the ex-ante cost and time of loan processing, institutions are encouraged to contribute credit information to the CIB database.

Report analysis by the CIB:

In order to disburse loans, a financial institution or bank obtains credit information about its customers by having the consumer provide basic information to BB on the prescribed form. In order to process the CIB data of applicants, banks and financial institutions divide the information into two categories:

- Personal Information

- Details of the proprietorship or company.

For individual information, CIB reports are required to have a legitimate NID. Other legitimate documents besides NID include a passport, driver’s license, birth certificate, and so forth.

Additionally, for proprietorship or company information, CIB reporting requires a valid NID of the owner/mandate holder/authorized signatory/ managing director/chairman, etc., in addition to a trade license/memorandum and articles of association (certified by RJSC).

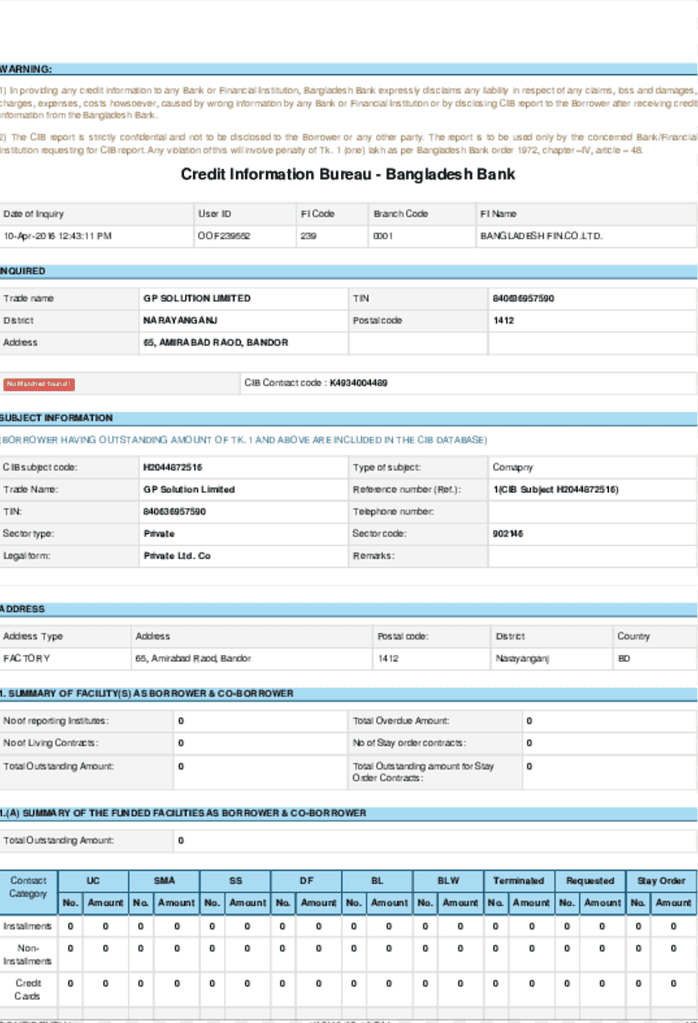

The CIB report

A CIB report is comprised of the following:

- The reference number

- The applicant’s name. (An organization or an individual)

- The function of the individual being questioned within CIB.

- The quantity of loan facilities that are registered in both the borrower’s or guarantor’s personal name and the name of the organization managed by the applicant.

- The aggregate amount that remains outstanding if the applicant is listed as the creditor or guarantor on any loan.

- The aggregate amount of delinquent payments, should the applicant be the creditor or guarantor of a loan.

- Account status such as NIL (the loan does not exist), STD (the standard), SMA (the specially mentioned account), DF (doubtful), BL (bad loss), and so forth.

Preservation of CIB report secrecy:

Article 46 of the Bangladesh Bank Order, 1972 outlines guidelines and prescriptions pertaining to the limited utilization of credit information. Additionally, this article specifies the consequences of divulging any credit information to customers or third parties. Additionally, this article states that commercial banks and FIs, including Bangladesh Bank, lack the authority to divulge or transmit comprehensive credit information of borrowers.

Promoting ‘trust’ between borrowers and its banks/FIs is the primary responsibility of the Credit Information Bureau (CIB), ensuring that the information of borrowers is not misused or mismanaged. However, it should be mandatory for all banks and FIs to uphold confidentiality within the CIB. This confidence encourages financial institutions to provide CIB with their credit information, thereby facilitating its more efficient and effective growth.

In the event that the CIB report regarding the borrower/customer is unfavorable, the banks/FIs may notify the client or prospective client in writing, via a confidential letter containing the following language: “Based on the credit information at our disposal, you have been identified as being in default on your accounts with one or more lending institutions.” You may request that your existing lending institutions convert the position to a regular one. Circular 1 of the CIB, dated January 8, 2005.

CIB Report Charges and Fees:

The applicant must provide information and a guarantee from his or her spouse in addition to a primary guarantor in order to obtain a loan. Most loans require the guarantee of three individuals. Therefore, these three individuals are required to file a CIB report. Each bank assesses Tk.300 (variable between banks) for each CIB inquiry. Bangladesh Bank has contributed Tk.300, while the remaining amount has been absorbed by CIB inquiry initiating banks and financial institutions.

Guidelines of the Bangladesh Bank for CIB:

FAQs:

1. What purpose does CIB reporting serve?

The Credit Information Bureau (CIB) of Bangladesh Bank is tasked with the monthly collection of credit-related data from financial institutions (FIs) concerning organizations or individuals. This data is considered concrete and dependable by FIs, as it aids them in decision-making processes pertaining to the issuance of new loans or the renewal of existing ones.

2. Is a CIB report for each loan mandatory?

Each loan that was submitted to the bank was subject to a CIB report prior to the disbursement of said loan. Certain financial institutions, including IDLC, IPDC, and others, required a CIB report prior to extending a new loan.

3. For how many days is a CIB report valid?

The validity of a CIB report is two months. When the inquiry date for a CIB report exceeds two months, it becomes mandatory to obtain a new CIB report prior to loan disbursement.

4. Is a CIB report mandatory for a new loan from the NGO?

No, the NGO has not requested a CIB report in order to grant a new loan as of yet.

Are you planning to do your company registration in Bangladesh?

Company formation and registration at Dewey Leboeuf: The Law Firm in Bangladesh:

The legal team of Dewey Leboeuf Law Firm in Bangladesh are highly experienced in providing all kinds of services related to forming and registering all sorts of companies in Bangladesh . For queries or legal assistance, please reach us at:

E-mail: info@trfirm.com

Phone: +8801847220062 or +8801779127165

Address: House 410, Road 29, Mohakhali DOHS

0 Comments